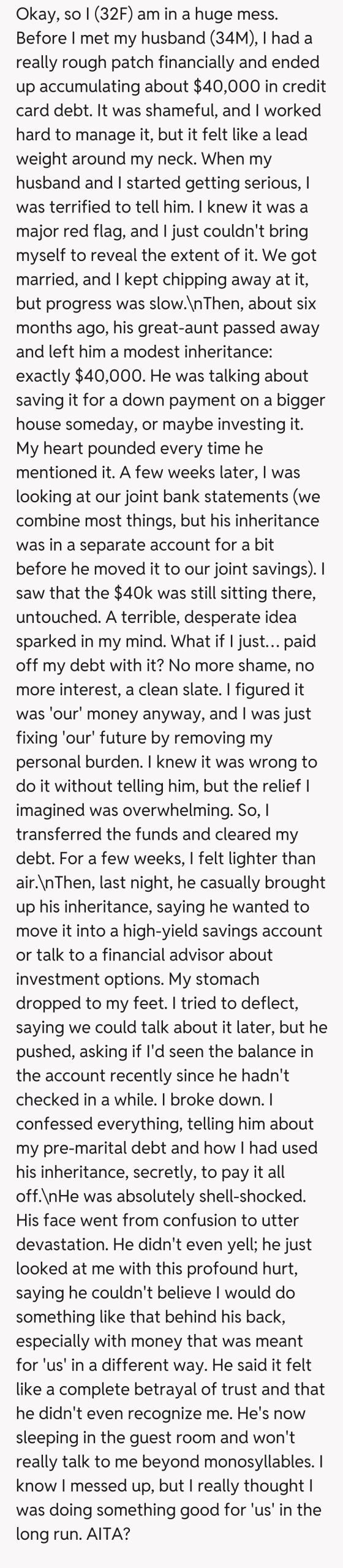

AITA for secretly using my husband’s entire inheritance to pay off $40k in credit card debt I racked up before we got married?

Oh, the tangled web we weave when financial secrets become part of a marriage! Today's AITA story brings to light a truly complex and emotionally charged situation that many will undoubtedly have strong opinions about. Our submitter, 'Debt-Ridden Darling,' found herself facing a pre-marital debt monster, and her solution involved a significant sum of her husband's inheritance. Talk about a high-stakes gamble!\nThis isn't just about money; it's about trust, transparency, and the delicate balance of individual finances within a partnership. When personal financial woes intertwine with shared futures and inherited wealth, the lines can blur rapidly, leading to profound emotional repercussions. Let's dive into the details and see what the internet thinks about this deeply uncomfortable scenario.

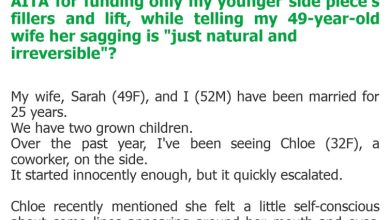

"AITA for secretly using my husband’s entire inheritance to pay off $40k in credit card debt I racked up before we got married?"

This story is a stark reminder of the paramount importance of financial transparency in a committed relationship, especially marriage. While the fear and shame associated with significant personal debt are undeniably powerful emotions, the decision to unilaterally use a partner's inheritance, and to do so in secret, fundamentally undermines the very foundation of trust.\nInherited money, even within a marriage, often carries an emotional significance beyond its monetary value. It's not just 'money in the bank'; it represents a legacy, a future aspiration, or a specific plan. Taking it without consent, regardless of the perceived 'good' intention, strips the owner of their agency and demonstrates a profound lack of respect for their individual assets and shared financial planning.\nThe core issue here isn't solely the debt itself, but the massive breach of trust. Marriage thrives on open communication and joint decision-making, particularly concerning significant financial matters. By keeping the debt a secret initially, and then compounding it with a clandestine act, OP has created a chasm that will be incredibly difficult to bridge. Her husband's reaction of shock and betrayal is entirely understandable.\nWhile the desire to eliminate debt is commendable, the method chosen here was deeply flawed. Had OP approached her husband with honesty about her pre-marital debt and discussed potential solutions, perhaps even including the inheritance as a joint decision, the outcome might have been entirely different. The secrecy transformed a shared problem into a unilateral act of perceived financial theft.

The Internet Weighs In: Trust, Debt, and Betrayal

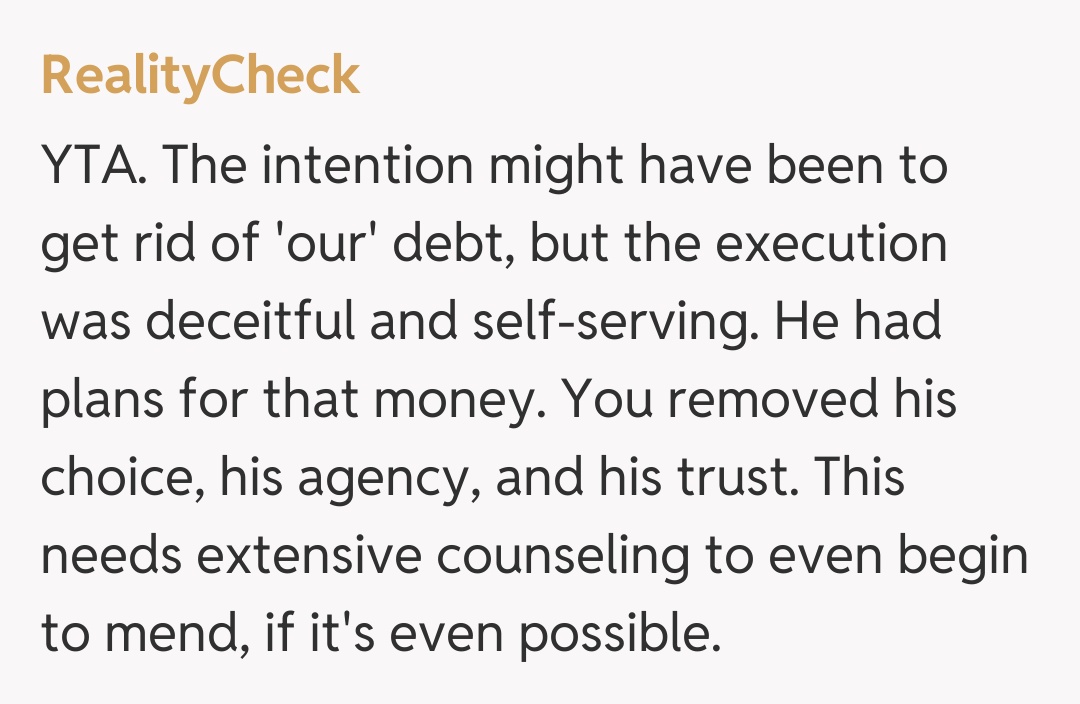

The comments section for this story is, predictably, a firestorm of strong opinions. The overwhelming sentiment leans towards NTA, with many users expressing deep empathy for the husband's position. The term 'financial infidelity' is popping up frequently, highlighting that for many, this act feels like a significant betrayal, akin to other forms of dishonesty in a relationship.\nMany commenters are focusing not just on the act of taking the money, but the years of secret-keeping about the debt itself, which laid the groundwork for this unilateral decision. There's a shared understanding that while debt can be terrifying, open communication is the only viable path in a partnership. The discussion often circles back to whether such a breach of trust is even repairable.

This AITA submission is a stark, painful lesson in the crucial role of financial transparency and trust within a marriage. While the initial shame of debt is relatable, compounding it with secrecy and a unilateral decision regarding a partner's inheritance created an almost insurmountable barrier. The path forward for this couple will undoubtedly be long and arduous, requiring intense honesty, professional guidance, and a monumental effort to rebuild the shattered trust. It serves as a powerful reminder for all couples to lay all financial cards on the table, no matter how uncomfortable, before saying 'I do.'