AITA for telling my wife she’s not allowed to spend any money on herself until our joint savings hit $50k, because “her nails and coffee runs are why we’re still renting”?

Financial friction in relationships is a tale as old as time, and today's AITA story perfectly illustrates how quickly resentment can fester when spending habits clash. Our original poster (OP) has dropped a rather severe financial ultimatum, directly blaming their partner's personal discretionary spending for their inability to save for a home. It's a bold move, and one that has certainly ignited a firestorm of discussion across the internet.

This scenario forces us to confront not just individual budgeting, but also the delicate balance of shared financial goals, communication breakdown, and the power dynamics within a marriage. Is it ever acceptable to dictate how a partner spends their own earned money, especially when pursuing a collective dream like homeownership? Let's dive into the full story and see what unfolded, before we dissect the implications.

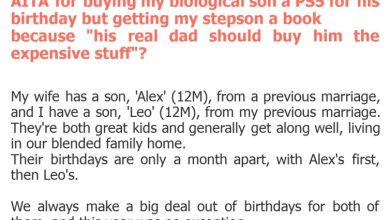

"AITA for telling my wife she’s not allowed to spend any money on herself until our joint savings hit $50k, because “her nails and coffee runs are why we’re still renting”?"

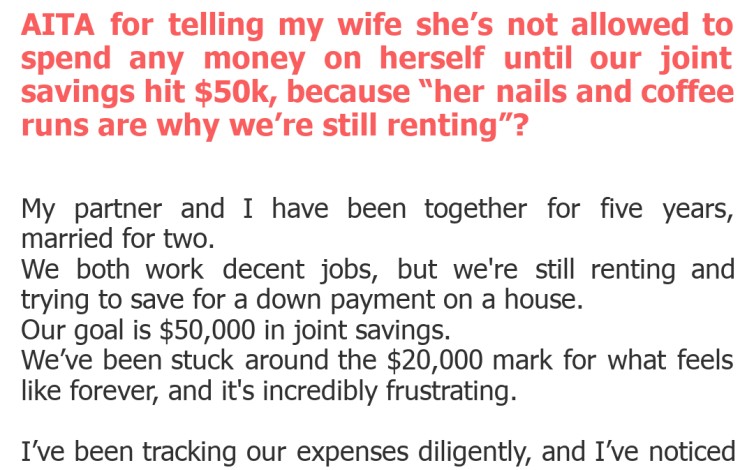

My partner and I have been together for five years, married for two. We both work decent jobs, but we're still renting and trying to save for a down payment on a house. Our goal is $50,000 in joint savings. We’ve been stuck around the $20,000 mark for what feels like forever, and it's incredibly frustrating. I’ve been tracking our expenses diligently, and I’ve noticed a pattern. While I'm very frugal, packing my lunch and making coffee at home, my partner enjoys a daily specialty coffee and gets their nails done every few weeks, plus other small personal treats. These aren't huge individual expenses, but they add up significantly over time.

I brought this up gently before, suggesting we both cut back, but my partner brushed it off, saying "it's not that much" and "everyone deserves small joys." I tried to explain that those "small joys" are precisely what’s keeping us from our bigger joy – a home. I feel like I'm the only one truly committed to our financial future. My partner contributes their share to the joint account for bills and some savings, but then seems to spend the rest of their personal money without much thought for our shared goal.

The other night, after another failed attempt to hit our monthly savings target, I finally snapped. I was looking at our bank statement, seeing the deductions for things I consider non-essential, and a wave of frustration just washed over me. I told my partner, directly and without sugarcoating it, that they're not allowed to spend any more money on themselves until we reach that $50k goal. I said those nails and coffee runs are why we're still renting, and it was time for them to sacrifice for our future.

My partner looked absolutely devastated. They accused me of being controlling and said I was infantilizing them. They argued that their personal spending money is theirs to use as they see fit, as long as their share of bills and savings is met. I countered that we have a *joint* goal, and if one person isn't pulling their weight in terms of discretionary spending, it affects both of us. We had a huge argument, and now my partner is giving me the silent treatment. I feel like I'm right to demand this sacrifice for our future, but the reaction was intense. AITA?

The original poster’s frustration is certainly understandable. When a couple has a shared financial goal, especially one as significant as a house down payment, it's natural for one partner to feel resentful if they perceive the other isn't making equal sacrifices. The slow progress towards their $50k target, coupled with observed discretionary spending, could easily lead to a build-up of stress and the feeling of being solely responsible for their financial future.

However, the method employed by the OP is where the situation becomes problematic. Issuing an ultimatum that dictates a partner’s personal spending, effectively "banning" them from buying anything for themselves, crosses a significant line into controlling behavior. While the intent might be to accelerate savings, it completely undermines autonomy and treats the partner like a child rather than an equal adult in the relationship.

Healthy financial partnerships rely on open communication, mutual respect, and collaborative decision-making, not decrees. Instead of a unilateral ban, the OP could have initiated a joint budget review, suggested specific categories for reduction *together*, or explored ways to increase income. Blaming one partner’s "nails and coffee" for their renting situation oversimplifies a complex financial picture and likely ignores other contributing factors.

Furthermore, these small personal treats often represent comfort or self-care for individuals, especially when facing the stress of financial goals. Stripping these away without discussion or compromise can lead to deep resentment, not cooperation. The partner’s devastated reaction and accusation of control are entirely valid responses to such an authoritarian demand, highlighting a significant breakdown in trust and communication within the relationship.

The Internet weighs in: Is it Frugality or Financial Tyranny?

The comment section, as expected, was a fiery battleground of opinions. Many users sided firmly with the partner, condemning the OP's ultimatum as overtly controlling and disrespectful. The common sentiment was that while shared goals are important, dictating another adult's personal spending is a huge red flag and a sign of deeper relationship issues, not just financial ones. Users emphasized that partnerships require collaboration, not commands.

Conversely, a smaller but vocal contingent empathized with the OP's frustration, especially regarding the shared financial goal. They argued that sometimes tough love is necessary when one partner isn't pulling their weight. However, even these comments often suggested that the *approach* was wrong, advocating for better communication and a joint budgeting strategy rather than a blanket ban on personal spending.

This story serves as a stark reminder that financial harmony in a relationship isn't just about the numbers; it's deeply intertwined with respect, communication, and shared values. While the desire for a home is commendable, achieving it through ultimatums often comes at the expense of the relationship itself. Open, honest dialogue about budgeting, sacrifices, and personal needs is crucial. A joint financial goal requires a joint, empathetic approach, ensuring both partners feel valued and respected throughout the journey.